Haga clic aquí para ver esto en español

Giving by U.S. districts and churches to the Pensions and Benefits Fund reached more than $14 million in 2022—the highest level since 2015, according to Kevin P. Gilmore, executive director of Pensions and Benefits USA (P&B) for the Church of the Nazarene. The detail was part of Gilmore’s 2023 Annual Report to the Board of General Superintendents and the General Board. This article includes highlights of that report.

Giving by U.S. districts and churches to the Pensions and Benefits Fund reached more than $14 million in 2022—the highest level since 2015, according to Kevin P. Gilmore, executive director of Pensions and Benefits USA (P&B) for the Church of the Nazarene. The detail was part of Gilmore’s 2023 Annual Report to the Board of General Superintendents and the General Board. This article includes highlights of that report.

P&B Fund giving for the year was up from $13.7 million in 2021. It marked the fourth consecutive year contributions have been stable and above levels for 2017-2018. This support enables P&B to continue to provide benefits and services for almost 17,000 active and retired ministers, church-employed laypersons, spouses, and widows.

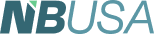

How P&B Funds Were Used in Fiscal Year 2022

The table here offers a snapshot of P&B Fund receipts for fiscal year 2022 as compared with the average for the prior seven fiscal years (2015-2021).

In prior years, two thirds of the budget was used to support contributions to the Single Defined Benefit Pension (SDBP) Trust. That figure dropped to 63% in 2022, and will continue to fall into the near future. Also in prior years, 16% of the budget was used to fund Annual Pension Supplement (APS) contributions to the accounts of eligible ministers in the 403(b) Plan. That result grew to 20% in 2022 and will continue to climb in the future.

Administrative expenses in 2022 represented 8.6% of P&B Fund receipts compared to the prior years’ average of 11.7%.

The Single Defined Benefit Plan (SDBP)

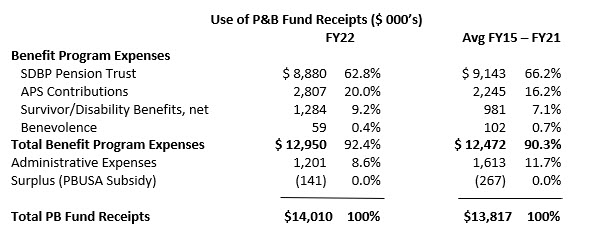

The SDBP paid $17 million dollars to participants in 2022, up from $16.1 in 2021. This included an additional $1.3 million extra benefit payment.

The SDBP includes the Basic Pension Plan for full-time pastors, evangelists, and district-credentialed laypersons; and the General Church Pension Plan for employees of the Global Ministry Center, Nazarene Theological Seminary, and Nazarene Compassionate Ministries, Inc.  It is funded through continued contributions from the P&B Fund, and earnings on investments. This plan, which was closed to new participants in 1996, distributes approximately 15% of its assets’ value to retired participants to meet current pension obligations. In 2022, P&B contributed $8.8 million to the SDBP plan.

It is funded through continued contributions from the P&B Fund, and earnings on investments. This plan, which was closed to new participants in 1996, distributes approximately 15% of its assets’ value to retired participants to meet current pension obligations. In 2022, P&B contributed $8.8 million to the SDBP plan.

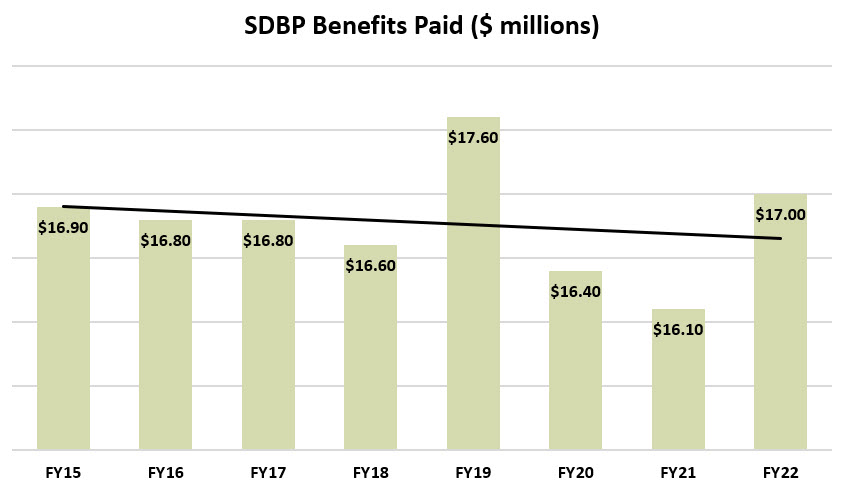

As of September 2022, the funded status of the SDBP was estimated to be 84.3%, after having reached the full-funding level in the previous year. This drop was caused by the overall decline in markets. To make progress toward again reaching full-funding, continued contributions are required from the P&B Fund and earnings and valuation growth on investments.

Nazarene 403(b) Retirement Savings Plan

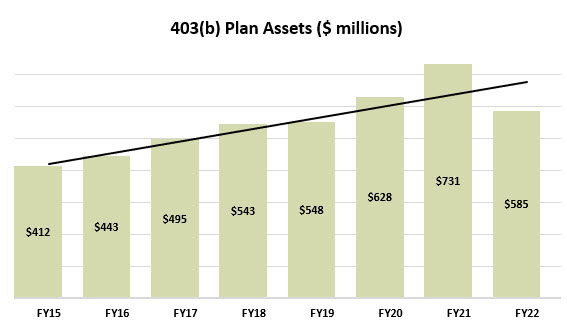

The volatile market in 2022 also affected assets of the Nazarene 403(b) Retirement Savings Plan. At the close of fiscal year 2022, assets totaled $585 million, down from 2021’s record high of $731 million.

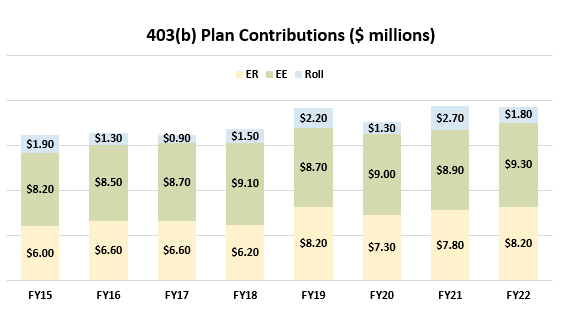

However, contributions to the 403(b) plan by employees, employers, and transfers via rollovers totaled $19.3 million. This was down slightly from the record high of $19.4 million in 2021.

P&B Fund Contributions to the 403(b) Plan (APS)

To assist with retirement savings, P&B deposits Annual Pension Supplements (APS) to the 403(b) accounts of eligible ministers. In 2022, P&B placed $2.8 million (up from $2.5 million in 2021) in the accounts of these participants. This included an extra, one-time bonus and matching contribution of $.88 million.

Insurance

P&B offers a number of group life benefits. These include a “survivor benefit” (life insurance), and long-term disability insurance. In 2022, we spent $1.2 million to provide these coverages for ministers. Last year, if the church of an eligible minister paid at least $1 to the P&B Fund, that pastor was covered by up to $30,000 in life insurance and $500 per month in long-term disability coverage.

Benevolence

P&B provides financial assistance for active and retired ministers or dependents who occasionally need help with emergency medical, funeral, or temporary monthly disability expenses. Requests for this assistance must be endorsed by a district. In 2022, we used $59,000 for benevolence.

Education

P&B continues to strive to inform ministers and church treasurers of matters that affect clergy and churches financially. To this end, we create electronic and printed materials, ranging from brochures and email blasts to newsletters and videos, about topics such as taxes, compensation, insurance, and retirement. Resources and information are largely disseminated through pbusa.org, email, and Facebook.

Fidelity Investments, our record-keeper and partner for the 403(b) Plan, joined with us to host 10 web workshops in 2022 on topics ranging from dealing with student debt to preparing for Social Security. We were present to answer questions about our benefits at the PALCONs in Nashville and Nampa, and participated in two district meetings, as well as the Korean Pastors Conference and the biannual gathering of the Association of Retired Ministers and Missionaries.

We continue to enhance the availability of our resources to ministers and local and district church treasurers through our electronic portals. In the coming year, we will offer an electronic newsletter and additional Spanish-language resources for Spanish-speaking ministers on U.S. districts.

The Future

The improved funding status of the SDBP provides P&B the opportunity to explore ways to further improve the benefits of those we serve. The one-time extra benefit payments to active and retired church employees in 2022 were a step in that direction. We were pleased to be able to do this, but we are exploring how we might offer financial assistance that is more sustainable. Our inclination is to focus on implementing appropriate incentives which require proactive contributions of the local pastor and/or their church to the pastor’s retirement.

The complete 2023 Annual Report of P&B, with financial statements, will soon be available at pbusa.org.