Written by Kevin P. Gilmore

From the Director

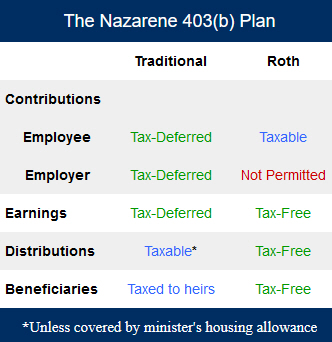

To understand the primary differences between the Traditional and Roth components within our Plan, see the table on the left.

To understand the primary differences between the Traditional and Roth components within our Plan, see the table on the left.

With the Traditional, all contributions go into your account on a tax-deferred basis, and all earnings accumulate the same way. Only when the funds are withdrawn through distributions are they subject to taxation, if not covered by the minister’s housing allowance exception.

In the Roth option, employee contributions are made on an after-tax basis, but earnings on those funds grow tax-free so, in retirement, Roth-related funds are distributed on a tax-free basis. Current law does not permit employers to contribute to a Roth 403(b) but, stay tuned, Congress is considering changes to allow that in the future. Employers may, however, currently contribute funds to a pastor’s Traditional account—and we strongly encourage every church to do this to help them prepare for a more secure future.

Per IRS regulations, Roth contribution limits are included within the total for all contributions to such retirement plans. A unique feature of the Roth is the requirement that the account remain in place for at least five years after the initial deposit of Roth-qualified funds, or they will not be eligible for distribution on a tax-free basis. Please keep that in mind during your planning as this is not a short-term decision.

If you are a minister, you may be thinking “Why would a Roth be good for me when I’m able to shelter Traditional distributions from tax as housing allowance?” That’s a great question, and leads right into my reason for recommending the use of a Roth in some manner.

The housing allowance exclusion is one of the most valuable benefits to which a minister is entitled—even in retirement. However, when a minister dies, the housing allowance benefit ends. Funds in a Traditional account that pass on to a surviving spouse or other heirs are no longer eligible for the shelter from tax provided by the housing allowance exemption.

I believe ministers, especially young ones, should consider contributing at least a portion of their retirement funds within the Roth component, so that after they die, they can be passed tax-free to their spouse or other heirs. Traditional funds inherited by a spouse/heir are completely taxable when withdrawn.

Of course, everyone’s financial situation is unique, which is why the advantages of the Roth option should be properly evaluated and pursued under the guidance of your personal tax and financial advisors.

Another reason for the Roth option is to provide a tax-advantaged plan for the non-ministerial staff of your church. While non-ministers are not eligible for APS (Annual Pension Supplement) benefits from P&B, they are eligible to participate in the Plan. Now, they may contribute to their own retirement through the Traditional or Roth option, and the local church should consider assisting them (as with their pastor) with a matching and/or direct contribution. But remember, current law permits employers to contribute only to the Traditional part of the Plan, not the Roth.

Investment choices for Roth funds are the same as for non-Roth contributions through our Plan’s existing, low-cost mutual funds structure with Fidelity Investments. There’s no need to consider investing Roth funds any differently than within your current Traditional investment allocation strategy.

Also, contributing Roth funds does not involve joining a new or separate plan. The only action on your part is to execute the appropriate paperwork to designate how much of your funds (elective deferrals from your paycheck) you wish contributed under the Roth option, then, be sure your church-employer is making it happen each pay period.

Within your account, funds and their related earnings will be tracked and reported separately within the Fidelity record-keeping system, so you will be able to identify the level of these funds at any point in time. As always, please contact our office at 888-888-4656 or pensions@nazarene.org if you have any questions about the Roth option or other P&B-provided benefits.

Kevin P. Gilmore serves as executive director of Pensions and Benefits USA for the Church of the Nazarene.